What we’re saving for in 2022 | Infographic

Our approach to saving and spending money undoubtedly changed during COVID-19 and resulting lockdowns, in fact, when we asked 2,000 UK adults, we discovered that over 50% of us altered our savings habits during lockdown.

We dived a little deeper to understand what changes, if any, we've made since lockdown and how these changes might have shaped our approach to saving money in 2022.

1. How the amount we saved changed after lockdown

Whilst the majority of us, perhaps seeking out stability amongst the chaos, kept our savings habits the same after lockdown, almost one-fifth are saving slightly more now. Just over 1 in 10 are saving less, with only a minority not saving anything at all.

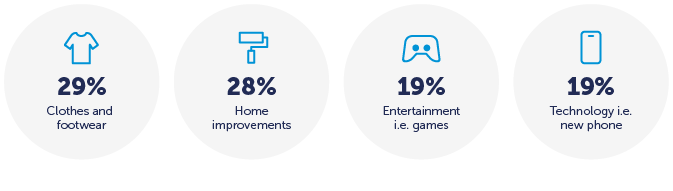

2. What we spent money on during lockdown

Even though many of us were confined to the house for long periods of time during lockdown, we spent the most money on clothes and footwear. A close second (and unsurprisingly) came home improvements – with new home offices, decorating and garden extensions becoming a priority!

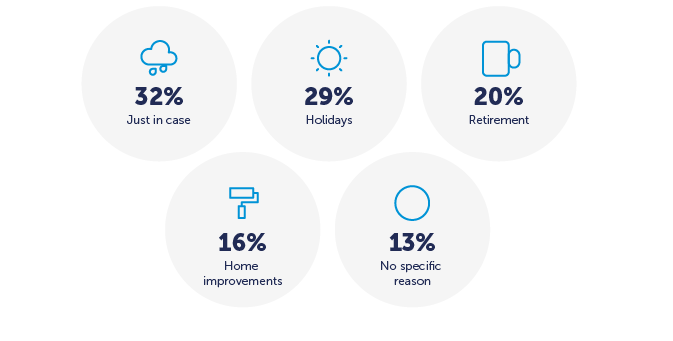

3. What we saved money for during lockdown

The most popular reason for saving money during lockdown was for emergencies or ‘just in case’ (at 32%), and it looks like that trend is set to stay, with 31% of people intending to stick to that with restrictions easing. Other more optimistic reasons include saving for holidays and retirement.

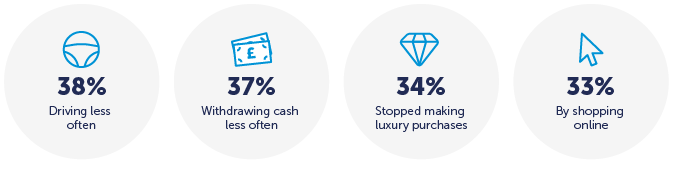

4. How we saved money during lockdown

The main reason that we were able to save money during lockdown was, by the majority, down to driving less often. Many of us didn’t have much of a commute anymore and limiting visits to friends and family meant we were staying put a lot of the time.

Other reasons we saved money include fewer cash withdrawals and limiting luxury purchases. We also discovered that 37% of us are likely to keep most of these lifestyle changes after restrictions have lifted.

5. What we’re saving money for in 2022

With light hopefully at the end of the tunnel, 40% of us are more determined than ever to save money. Unsurprisingly, the number of people now saving for a holiday has risen to just over 28%, with retirement remaining a similar priority, and home improvement coming up the list at 16.4%.

Maru conducted research among 2,000 adults living in the UK on behalf of Charter Savings Bank between 7 and 12 July 2021.

Savings

Popular posts like this

- Autumn Budget – ISA allowance update

- We’ve won Best Overall Savings Provider – for the eighth year running!

- How UK households are building financial safety nets

- Find out why every pound counts

- Saving smarter: myths vs reality

- Sunny Day Savings

- Be ISA Wiser about the new ISA changes

- Is an Easy Access account for you?

- 5 savvy saver tips to build your money

- Could you boost your pension pot with an ISA?

- Head in a spin? Your ISA questions answered

- Time to celebrate 10 years of CSB

- We’re your ISA Provider of the Year!

- Key Savings Definitions You Should Know

- Three ways to be ISA wiser before the tax year ends

- Five advantages of Easy Access savings accounts

- What is a Fixed Rate Bond?

- Cash ISA transfers – what do you need to know?

- 3 reasons why an Easy Access Cash ISA may be a good savings option for you

- Personal Savings Allowance – what’s it all about?

- Understanding different types of ISA

- The 9 most important Cash ISA questions you need to ask

- Top 3 ways to make the most of your ISA before the end of the tax year

- Did you know you could earn monthly interest by opening one of our fixed rate bonds?

- 12 ways to save money at Christmas

- What kind of saver are you?

- We’ve made improvements to your maturity options journey

- Could a Notice account be good for you?

- We’re your ISA Provider of the Year - for the fifth year running!

- You voted us Online Savings Provider of the Year

- Cash ISA transfers – what do you need to know?

- Thank you for voting for us at the Moneyfacts Awards

- Supporting you through a bereavement

- Award-Winning Savings

- What we’re saving for in 2022 | Infographic

- A huge thank you!

- How much should I be saving? | UK average savings by age

- Savings accounts: everything you need to know

- Understanding different types of ISA

- Revealed: average pocket money in the UK

- The 9 most important ISA questions you need to ask

- Customers vote Charter Savings Bank Best Online Savings Provider for third year in a row

- Charter Savings Bank strikes twice at the Moneynet Awards

Categories

More news

Financial Services Compensation Scheme

Your eligible deposits held by a UK establishment of Charter Savings Bank are protected up to a total of £120,000 by the Financial Services Compensation Scheme, the UK’s deposit protection scheme. Any deposits you hold above the limit are unlikely to be covered. Please click here for further information or visit www.fscs.org.uk.