Personal Savings Allowance – what’s it all about?

You might have heard the term Personal Savings Allowance but may not be quite sure what it means.

So, what is your Personal Savings Allowance?

In short, it’s the amount of interest you can earn before you need to start paying tax on your Savings as highlighted below:

- Basic rate (20%) taxpayers can earn £1,000 in tax-free interest.

- Higher rate (40%) taxpayers – £500 in tax-free interest.

- Additional rate (45%) taxpayers – £0.

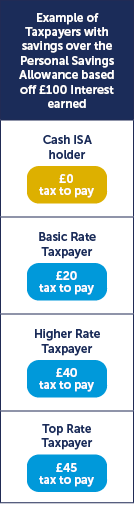

This example shows you how this might work in real terms:

Why is it important now?

The Personal Savings Allowance was introduced by the government in 2016 and since then savings interest rates have been relatively low.

However, in the last year, we've seen 8 Bank of England rate increases, and while this is exciting for Savers, you need to be aware that the additional interest you’re earning may take you above the Personal Savings Allowance threshold as shown above.

If the total interest earned is above your Personal Savings Allowance threshold and you are employed or receive a pension, HMRC may change your tax code and automatically collect any tax due. If you are self-employed, it is your responsibility to pay any tax through your annual self-assessment tax return.

If you’re unsure on the interest you have earned then your Bank or Building Society can help you with this.

Just remember though, the Personal Savings Allowance refers to the interest you earn on all of your Savings across different banks and building societies, so it could soon add up.

What about ISAs?

Good news – interest earned in an ISA doesn’t count towards your allowance. Even if the Personal Savings Allowance limits change, your ISA interest will still be protected. What’s more, if you move into a different tax band, or interest rates change, your ISA interest will remain tax-free.

If you still have questions, we have put together this handy guide which you may find useful.

If you think you might be reaching your Personal Savings Allowance limit, or just want to check if you could earn a higher rate of interest, please have a look at our savings accounts to see if they could be right for you.

Starting rate for savers

It’s also worth noting that if your income is less than £17,570 you may also earn up to £5,000 of interest without having to pay tax on it. This is your starting rate for savings.Every £1 of other income above your Personal Allowance reduces your starting rate for savings by £1.

To find out more about tax-free interest on your savings, you can visit GOV.UK.

Tax treatment depends on the individual circumstances of each customer and may be subject to change in future.

Savings

Popular posts like this

- Autumn Budget – ISA allowance update

- We’ve won Best Overall Savings Provider – for the eighth year running!

- How UK households are building financial safety nets

- Find out why every pound counts

- Saving smarter: myths vs reality

- Sunny Day Savings

- Be ISA Wiser about the new ISA changes

- Is an Easy Access account for you?

- 5 savvy saver tips to build your money

- Could you boost your pension pot with an ISA?

- Head in a spin? Your ISA questions answered

- Time to celebrate 10 years of CSB

- We’re your ISA Provider of the Year!

- Key Savings Definitions You Should Know

- Three ways to be ISA wiser before the tax year ends

- Five advantages of Easy Access savings accounts

- What is a Fixed Rate Bond?

- Cash ISA transfers – what do you need to know?

- 3 reasons why an Easy Access Cash ISA may be a good savings option for you

- Personal Savings Allowance – what’s it all about?

- Understanding different types of ISA

- The 9 most important Cash ISA questions you need to ask

- Top 3 ways to make the most of your ISA before the end of the tax year

- Did you know you could earn monthly interest by opening one of our fixed rate bonds?

- 12 ways to save money at Christmas

- What kind of saver are you?

- We’ve made improvements to your maturity options journey

- Could a Notice account be good for you?

- We’re your ISA Provider of the Year - for the fifth year running!

- You voted us Online Savings Provider of the Year

- Cash ISA transfers – what do you need to know?

- Thank you for voting for us at the Moneyfacts Awards

- Supporting you through a bereavement

- Award-Winning Savings

- What we’re saving for in 2022 | Infographic

- A huge thank you!

- How much should I be saving? | UK average savings by age

- Savings accounts: everything you need to know

- Understanding different types of ISA

- Revealed: average pocket money in the UK

- The 9 most important ISA questions you need to ask

- Customers vote Charter Savings Bank Best Online Savings Provider for third year in a row

- Charter Savings Bank strikes twice at the Moneynet Awards

Categories

More news

Financial Services Compensation Scheme

Your eligible deposits held by a UK establishment of Charter Savings Bank are protected up to a total of £120,000 by the Financial Services Compensation Scheme, the UK’s deposit protection scheme. Any deposits you hold above the limit are unlikely to be covered. Please click here for further information or visit www.fscs.org.uk.