We're currently experiencing higher-than-usual call volumes, which may result in longer call waiting times. Thank you for your patience and understanding.

We're currently experiencing higher-than-usual call volumes, which may result in longer call waiting times. Thank you for your patience and understanding.

Knowing how much money to pay your kids isn’t easy. To understand the average pocket money paid in different parts of the UK, we recently surveyed parents and grandparents to learn more about the decisions that we make when paying an allowance to our kids.

Pocket money is a hotly contested topic in some UK households, with kids’ demand for the latest gadgetry and games usually the driving force behind the crusade for more cash. But knowing just how much money you should pay kids, doesn’t always come easily.

Our research found that parents and grandparents spend an astonishing £11.1 billion on pocket money each year, and they also told us that the amount of cash they hand over to kids largely comes down to the following factors:

The average amount of pocket money paid by parents and grandparents in the UK is almost £13 per week, with the most amount of people paying between £5 and £9.99. Meaning that on average, UK children are earning just over £50 in pocket money each month.

You may also want to consider how much your kids are earning elsewhere, for example, we found that collectively parents and grandparents spend over £213 million on pocket money every week.

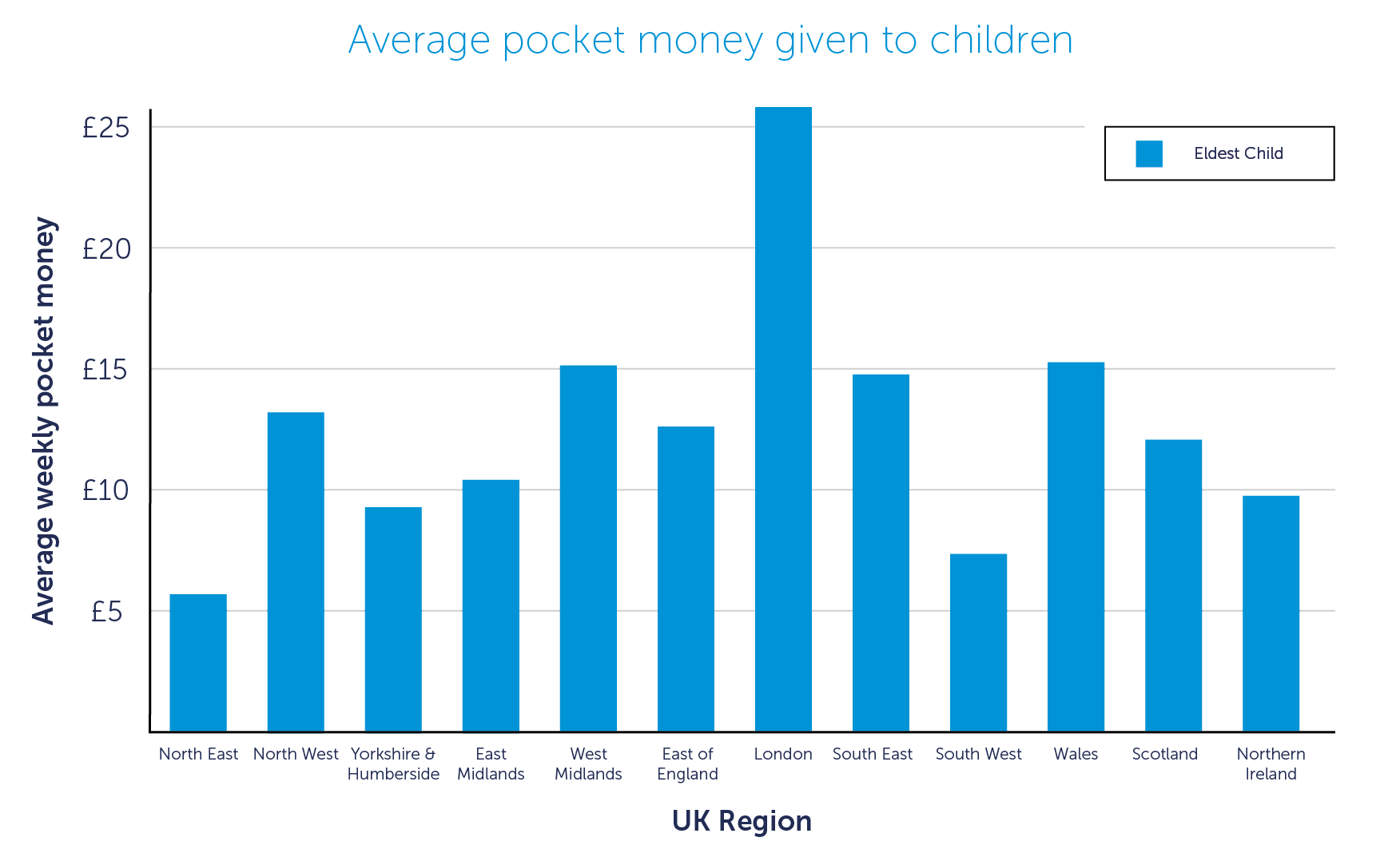

If you’re more interested in paying the going rate according to your region of the UK, you may find the following graphic useful:

We also found that not all of us pay siblings the same amount and, that on average, first-born children receive 34% (over £190) more from parents each year – so it pays to be the first born child.

Your kids are sure to have ideas about what they’d like to spend their money on as soon as they get it. Perhaps they’re on their way to the sweet shop as soon as you hand over the money, or maybe they’re set on trying on yet another trendy t-shirt.

Most of us would be more comfortable paying a bit more pocket money each month if we knew our kids or grandkids were using it for their future, or that they’re passionate about putting it towards a cause that they really care about.

36% of people told us they encourage their kids with advice about how to spend and save pocket money, so that it can be spent less flippantly on something that kids really want.

Here’s a few alternative ideas to help encourage your kids not to waste their weekly budget.

By paying money straight into your child’s piggy bank you’ll be surprised at how excited your kids will be as their savings grow and their piggy bank gains in weight. Just be sure to add their pocket money at the same time each week – routine is key to saving!

They’ll also understand the down side to removing money (and having less in there) if they choose to spend some.

By paying some of their pocket money directly into a savings account, you’re joining 19% of people in the UK who insist on keeping some of their pocket money out of reach from their kids.

It makes sense to form a savings habit early, and by paying into a savings account, you’ll also benefit from the interest and security that a savings bank provides.

If you’re worried about your kids wasting money, spend a little time each week to talk about the things your kids are planning on spending their pocket money on, and perhaps plant an idea for something more worthwhile, maybe to save up for a stationary kit to help with homework, or some tools to spend some family time in the garden.

This is a good way to make sure their pocket money goes further than the corner shop, and a way for them to realise the benefit of hanging on to their cash for the long run or at least something they really want.

There’s nothing more rewarding than seeing children do a good deed. Helping people is a wonderful sentiment to pass on to your kids, and so if they’re struggling for ideas to spend their money on, why not donate to a cause that’s close to their heart.

If you need help finding a cause that your child is excited to donate to, visit the charity register on gov.uk where you can search through a list of registered charities.

It’s generally easier to save if you do so on the day that you get paid, so consider having a conversation about saving money with your kids or grandkids on the day that you hand over their pocket money, helping firmly cement a savings mind-set into their future.

For example, you could explain that saving just half of their £50 each month (the average amount paid in the UK) would enable them to build up £300 over a year, which is money they can earn interest on and put towards future adventures – whilst leaving enough for them to spend on things they want more immediately.

It’s a great chance to help kids start to make spending and savings decisions, as well as understand the importance of having money saved for emergencies.

It’s generally easier to save if you pay money into a savings account on the day that you get paid, so consider having a conversation about saving money with your kids or grandkids on the day that you hand over their pocket money, helping firmly cement a savings mind-set into their future.

Source: Opinium conducted research among 2,009 adults living in the UK on behalf of Charter Savings Bank between 13th and 15th August 2019

Your eligible deposits held by a UK establishment of Charter Savings Bank are protected up to a total of £85,000 by the Financial Services Compensation Scheme, the UK’s deposit protection scheme. Any deposits you hold above the limit are unlikely to be covered. Please click here for further information or visit www.fscs.org.uk.